if i am a bitcoin investor what newsletter should i subscribe to and read

I've been watching this bitcoin situation for a few years, assuming it would just accident over.

But a collective insanity has sprouted around the new field of "cryptocurrencies", causing an irrational gilt blitz worldwide. It has gotten to the point where a big number of fiscal stories – and questions in my inbox – inquire whether or non to "invest" in BitCoin.

Allow'due south start with the answer: no. You should not invest in Bitcoin.

The reason why is that it's not an investment; just as gold, tulip bulbs, Beanie Babies, and rare baseball game cards are also not investments.

These are all things that people have bought in the past, driving them to cool prices, not considering they did anything useful or produced money or had social value, but solely because people thought they could sell them on to someone else for more than coin in the future.

When you make this kind of buy – which yous should never do – you are speculating. This is not a useful activity. You lot're playing a psychological, win-lose battle against other humans with coin every bit the sole objective. Fifty-fifty if y'all win money through dumb luck, yous have lost time and energy, which ways yous accept lost.

Investing means ownership an nugget that actually creates products, services or cashflow, such equally a assisting business concern or a rentable piece of real manor, for an extended period of time. An investment is something that has intrinsic value – that is, it would be worth owning from a financial perspective, fifty-fifty if you could never sell it.

To respond why bitcoin has become so big, we need to dissever the usefulness of the underlying technology chosen "blockchain" from the mania of people turning bitcoin into a big dumb lottery. Blockchain is only a swell software invention (which is open-source and free for anyone to employ), whereas bitcoin is just one well-known way to utilize it.

Blockchain is a figurer protocol that allows two people (or machines) to do transactions (sometimes anonymously) even if they don't trust each other or the network betwixt them. It can have monetary applications or in sharing files, merely it's not some instant trillionaire magic.

As a existent-world comparison for blockchain and bitcoin, take this example from the blogger The Unassuming Banker:

Imagine that someone had found a cure for cancer and posted the step-past-step instructions on how to make it online, freely available for anyone to use.

Now imagine that the same person as well created a product chosen Cancer-Pill using their own instructions, trade marked it, and started selling it to the highest bidders.

I retrieve we tin all agree a cure for cancer is immensely valuable to society (blockchain may or may non exist, nosotros still have to encounter), nevertheless, how much is a Cancer-Pill worth?

Our banker goes on to explain that the first Cancer-Pill (bitcoin) might initially see some great sales. Prices would rise, peculiarly if supply was limited (simply as an bogus supply limit is built into the bitcoin algorithm).

But since the formula is open up and gratis, other companies quickly come out with their own cancer pills. Cancer-Abroad, CancerBgone, CancEthereum, and whatsoever other number of competitors would spring upwards. Everyone can make a pill, and it costs but a few cents per dose.

Nevertheless imagine everybody starts bidding upwardly Cancer-Pills to the point that they cost $17,000 each and fluctuate widely in toll, seemingly for no reason. Newspapers start reporting on prices daily, triggering so many tales of instant riches that even your hairdresser and your massage therapist are offering tips on how to invest in this new "asset form".

Instead of seeing how ridiculous this is, more people start bidding up every new variety of pill (cryptocurrencies), until they are some of the most "valuable" things on the planet.

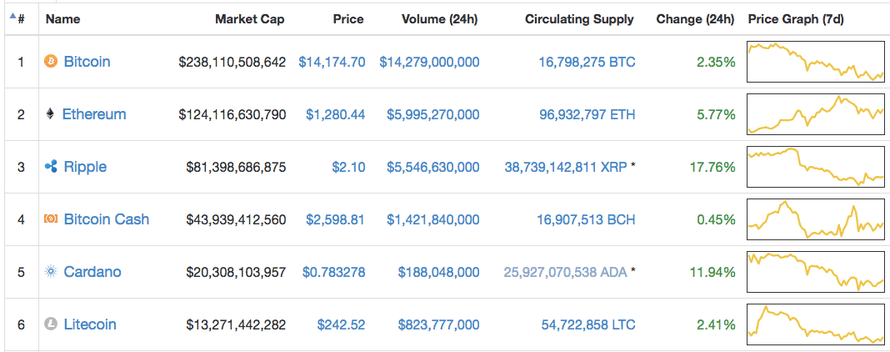

That is what'due south happening with bitcoin. This screenshot from coinmarketcap.com illustrates this real-life human herd behavior:

"Holy shit!" is the only reasonable reaction.

You've got bitcoin with a market value of $238bn, then Ethereum at $124bn, and so on.

The imaginary value of these valueless bits of computer information represents plenty money to change the form of the human race, for example, eliminating poverty or replacing the world's 800 gigawatts of coal power plants with solar generation.

Bitcoin (AKA Cancer-Pills) has become an investment bubble, with the complementary forces of human herd behavior, greed, fear of missing out, and a lack of understanding of by fiscal bubbles amplifying it.

To better sympathize this mania, we need to look at why bitcoin was invented in the first place.

Every bit the fable goes, in 2008 an anonymous programmer published a white paper under the simulated name Satoshi Nakamoto. The author was evidently a software and math person. But the paper also has some in-congenital ideology: the assumption that giving national governments the ability to monitor flows of money in the financial organisation and use it equally a class of law enforcement is wrong.

This financial libertarian streak is at the cadre of bitcoin. You'll hear echoes of that sentiment in all the pro-crypto blogs and podcasts.

The sensible-sounding ones will say: "Sure the G20 nations all have stable fiscal systems, but bitcoin is a lifesaver in places like Venezuela where the authorities tin can vaporize your wealth when you slumber."

The harder-core pundits say: "Even the Us Federal Reserve is a agglomeration 'a' crooks, stealing your coin via inflation, and that nasty fiat currency they issue is nothing but toilet paper!"

It's nonetheless stuff that people say about gold – another waste of man investment energy.

Government-issued currencies have value because they represent human trust and cooperation. There is no wealth and no merchandise without these two things, and so yous might too get all in and trust people.

The other argument for bitcoin'southward "value" is that there will simply ever exist 21m of them, and they volition eventually replace all other earth currencies, or at to the lowest degree get the "new gold", and then the central value is either the entire world's Gdp or at least the total value of all aureate, divided by 21m.

People who think that there'southward even a tiny run a risk bitcoin could become a earth currency say it is severely undervalued.

Y'all could make the same argument most my fingernail clippings: they may have no intrinsic value, just they're in limited supply so let's apply them as the new world currency.

Let's get this direct: in lodge for bitcoin to be a real currency, information technology needs several things:

- Like shooting fish in a barrel and frictionless trading between people.

- To be widely accustomed as legal tender for all debts, public and private.

- A stable value that does not fluctuate (otherwise it's incommunicable to set prices).

Bitcoin has none of these things, and even safely storing it is hard. Bitcoin exchanges such every bit Mt Gox in Nihon, Bitfinex and various other wallets and exchanges have been hacked.

The second signal is crucial. Bitcoin is simply valuable if it truly becomes a critical world currency. In other words, if you truly need it to buy stuff, and thus you need to buy coins from some other person in society to conduct important bits of world commerce that yous tin can't do any other way. Right at present, speculators are the just people driving upwardly the cost.

A speculative cult currency like bitcoin is only valuable when yous cash information technology out to a existent currency, like the United states of america dollar, and apply it to buy something useful similar a prissy business firm or a business. When the supply of foolish speculators dries upwards the value evaporates – often very rapidly.

A currency should also non be artificially sparse. It needs to expand with the supply of appurtenances and services in the world, otherwise nosotros end upward with deflation and hoarding. It helps to accept the Federal Reserve system and other fundamental banks guiding the system.

Finally, nothing becomes a skillful investment just considering "it's been going upwardly in price lately".

The world's governments are non going to let everyone outset trading money anonymously and evading taxes using bitcoin. If cryptocurrency does take off, it will be in a government-backed form, like a new "Fedcoin". Full anonymity and government evasion volition non be one of its features.

The cryptocurrency bubble is actually a repetition of the by. This is a known problems in our operating organization, and nosotros take designed some parts of our society to protect united states of america against it.

These days, stocks in the US are regulated by the Securities and Exchange Commission, precisely, because in the olden days, there were many stocks issued that were much like bitcoin, marketed to unsophisticated investors as a become-rich-quick scheme. The very definition of this investor is: "Beingness more willing to purchase something the more its price goes up."

Don't be i of these fools.

A version of this post originally appeared on the blog mrmoneymustache.com, where financial blogger Mr Money Mustache (Pete Adeney) writes about how to "live a frugal yet badass life of leisure".

Source: https://www.theguardian.com/technology/2018/jan/15/should-i-invest-bitcoin-dont-mr-money-moustache

Post a Comment for "if i am a bitcoin investor what newsletter should i subscribe to and read"